By Ron Burgess and Edward B. Lasak, CPA

This article is the third of a series on how to increase business valuations and reduce risk by using value-building models that are available in the marketplace. My analysis comes from 35 years of experience as a CFO, COO, and Treasurer at Public and Private Companies and six years as family business consultant.

Series of Articles on Value-Building Models

This series describes value-building models that increase the appraised value of a company by increasing future cash flows, improving the sales multiple, and reducing operating risk. Moreover, it adds a CFO’s perspective of each model. Here is a summary of first three articles written:

Article One: Why Is Building Value So Important?

Article Two: The Valuation Wheel: Eight Strategic Business Drivers That Build Value and Reduce Risk.

Article Three: The Value Diamond Value Model

Introduction

In this article, we present Value Diamond Model. This model that was developed by Ron Burgess who has a 35-year career as a marketing professional, business owner, and consultant. Ron started marketing company called Red Fusion where he created and managed over 500 websites and marketing plans. From this experience, Ron has become a marketing expert. He is someone you will want to consult with about improving customer engagement, managing customer relationships, differentiating your business from competitors, growing revenue, and increasing operating gross profit margins.

If your goal is to optimize value for your shareholders, this article is a must read. Specifically, it provides a foundation for monetizing your position in the marketplace and increasing the stickiness of your customers making your company more indispensable to them. It gives you a process on how to improve customers stickiness and top-line revenue from a customer and market perspective.

The Value Diamond Model

The Value Diamond of customer perceived value is a model to help evaluate how customers compare a company’s product or services with its competitors. It was constructed as an easy and quick way to help clients improve and grow revenue. The concept is based on a marketing approach that customers ultimately shape company value based on their buying behaviors. Buying behaviors are driven based on perceived value.

Getting Started on a Strategic Plan

Small business owners are often “just too busy” to start and complete a comprehensive strategic plan. It is easy to criticize them for not taking the time, except it is often true that to keep the business going, owners need to work in the business and rarely have time to work on the business.

Conducting regular involved strategy sessions is seen as an exercise that can greatly increase the total value of a business. But time, knowledge of the process, and lack of other managers in a business can fall to the owner alone. While good planning can happen in this scenario, it often falls behind daily demands. It can also miss the valuable input from employees and a realistic look at competitors, external threats, and opportunities. Very small businesses also lack the cash to get outside help from professionals.

The Value Diamond can bridge that gap by providing an easy process with modest time commitments to start developing value-building strategies. It works as a first step and provides a periodic snapshot on areas that need improvement in your business. Furthermore, it starts with the most important component of your business and that is your customers. Generally, adding emphasis on planning tends to increase value. Likewise, structuring management to allow more executive time for this process will become a long-term benefit.

Perceived Value

A customer’s perceived value is constructed from four buying elements: 1) quality, 2) customer service, 3) the price, and 4) the perceived image (or branding) of the company. In the world of marketing, customer perception is more important than reality because only buying behavior affects revenue.

The use of other value-building models is desirable and necessary because operational issues drive margins and profits which in-turn drive profits and business valuations. The Valuation Wheel discussed in article 2 is a good model for looking at the financial and operational aspects of business valuations.

Use of the Value Diamond serves as a way to compare products and services between companies, so the examination yields a priority of what aspects of operations should achieve the greatest benefit.

Unlike the more structured approaches previously mentioned, the Value Diamond can be easily estimated by managers and salespeople who are aware of competitive forces. This simple approach is completed in just a few minutes while most evaluation methods require considerable discovery before making the evaluation.

This approach allows an initial quick shot of the customer’s perceived value, while encouraging more discovery and research to verify and deepen the analysis. Advanced approaches break down the four dimensions into component parts allowing greater accuracy and insight.

Examples include customer feedback loops to gain objective information. These methods include consistent periodic surveys, active competitor databases, product engineering improvement data, and customer service records of product and customer interaction.

The diamond is a spider chart with four dimensions, thus the “diamond”. Using a scale of 1-5 each of the dimensions (or characteristics) is scored.

- Quality 1- is low, 5 is high

- Service 1- is low, 5 is high

- Image 1- is low, 5 is high

- Price 5 is low, and 1 is high

Each characteristic is scored for the company and two (or three) competitors. They can be used in a simple chart like below or plotted on a spreadsheet using the format below and charted in a spider graph.

| Your Company | Competitor 1 | Competitor 2 | Competitor 3 | |

| Quality | ||||

| Service | ||||

| Image | ||||

| Price |

Scores between 1 and 5 are then entered into a spreadsheet and plotted using a spider chart.

Quality, service, and image are scored 5 is high, and 1 is low, while price is scored the opposite; 1 is high price and 5 is low price.

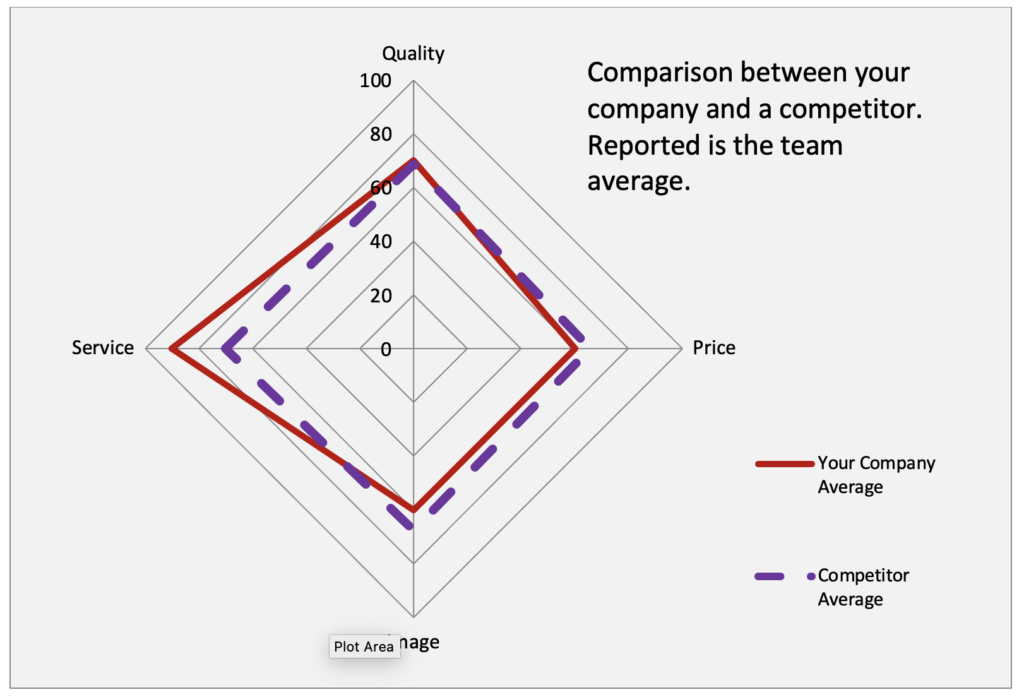

Note above: This image uses a scale from 0 to 100 because it is an advanced, calculated model based on outside feedback. When using the tool manually the 0-5 model seems to be less confusing, however the outcome is the same.

The gap between the subject company and competitors become the areas that need action. Note above that there is a substantial “gap” in service. Your company has a perceived advantage over the competitor in service delivered. When the quality is the same, and image is lower, the real service image could be better communicated which may allow a matched price as well.

Additionally, the relative gap differences can be easily evaluated to determine investments required compared to the relative value gained compared to competitors. This is a quick way to determine what issues need work first.

For example, if image and quality are lagging behind competitors, it may be that improving image is much less costly than completely re-engineering a product line. While both should be of concern, with a limited budget, image can be helped in a short time while new engineering or a continuous improvement process would take months or years. Therefore, the priority of tasks is easily determined compared to other strategic development models.

The Value Diamond is not intended to replace strategic planning but to jump start it or supplement it. It does not take into account many operational inefficiencies or HR and other administrative issues. Therefore, other models are more appropriate. However, the argument for a quick start rather a delayed start or an incomplete plan is a strong one. Adding this as a model to all strategic planning processes is also beneficial. We suggest that you continue your planning process using one of the systems described by this series of articles.

A CFO Perspective

Creating value of a business starts with its customers. Without them, there is no effective business model. Therefore, any serious value-building model should start by analyzing the perceived value of its customers, thereby knowing what differentiates your company from its competitors. This is where The Value Diamond excels and adds value. The Value Diamond Model measures the perceived value of its customer by analyzing four buying factors: quality, customer service, image, and price.

This is a productive model for starting the value-adding process or adding it to the model that you are using. From a CFO’s perspective, I endorse this model because it adds balance to the value building process by emphasizing what makes you different to your customers. Many times, value-adding models place too much emphasis on expense cutting initiatives because many times that is the easier action to take. This model forces you to focus time and effort on probably the most important value driver and that it the relationship with its customers.

Conclusion

What makes the Value Diamond Model especially noteworthy is that it measures the perceived value of customers. The higher the perceived value of customers, the stickier customers are, and this stickiness leads to reduced customer turnover and increased revenue spending. It is a powerful tool for analyzing the quality of revenue, and likewise, can be used to create future value.

The Value Diamond Model provides a simple methodology for measuring your customers perceived value of your company from anecdotal feedback from sales and marketing personnel or more objective data from your marketing system. Moreover, it allows you to compare your company with its competitors, thereby helping you understand your competitive advantage and opportunities for improvement. Due to its simplicity, it can be the first step of beginning a strategic planning process, or it can add significant value to your exiting value building model that may be deficient of the customer analysis with your company.

In summary, it is a value-building model that you should adopt no matter what other overriding model you have selected for adding shareholder value. It focuses on the concept that customers ultimately shape company value by the buying decision they make daily.

Likewise, this model can measure the perceived value of competitors, and thereby can provide insights on how you can differentiate your company against them. We have all heard how important the market and customers are for driving revenue, but how many of us have taken the time to measure comparisons with competitors. This model provides a simple methodology to make these observations.

For more detailed information on the Burgess Value Diamond: The Mystery of Why People Buy: It’s The Perceived Value – RedFusion Media

About the Authors:

Ron Burgess

Ron Burgess is a serial entrepreneur who has started six businesses; all achieving market success. He started his consulting career following his tenure as the Director of Management Services for a national consulting firm in the 1980’s. There he developed business analysis products used by many hundreds of businesses. He has been a full-time consultant to small business since 1989, and is a recognized expert in the field. In retirement, he is on several company and non-profit boards, and founded a non-profit, MicroGiants Mentoring to record and transfer his knowledge, tools and experience to young individuals who want to start businesses. Connect on Ron Burgess | LinkedIn or MicroGiants.biz

Edward B. Lasak

Ed is a business strategist who has 35 years of experience working as a CFO, COO, and Treasurer at publicly and privately owned companies as well as local government. From his unique experience, he is skilled at using financial numbers and valuation methodology as operational metrics in managing operations and distribution for greater performance. He also successfully leverages IT solutions and new technology for improved operations. Ed is a CPA and has a Bachelor and Master of Science Degrees from Illinois State University. He is certified as a COSO Internal Control expert by the American Institute of Certified Public Accountants.