HIRE AN EXPERIENCED, FOUR-STAR CFO To Build Value

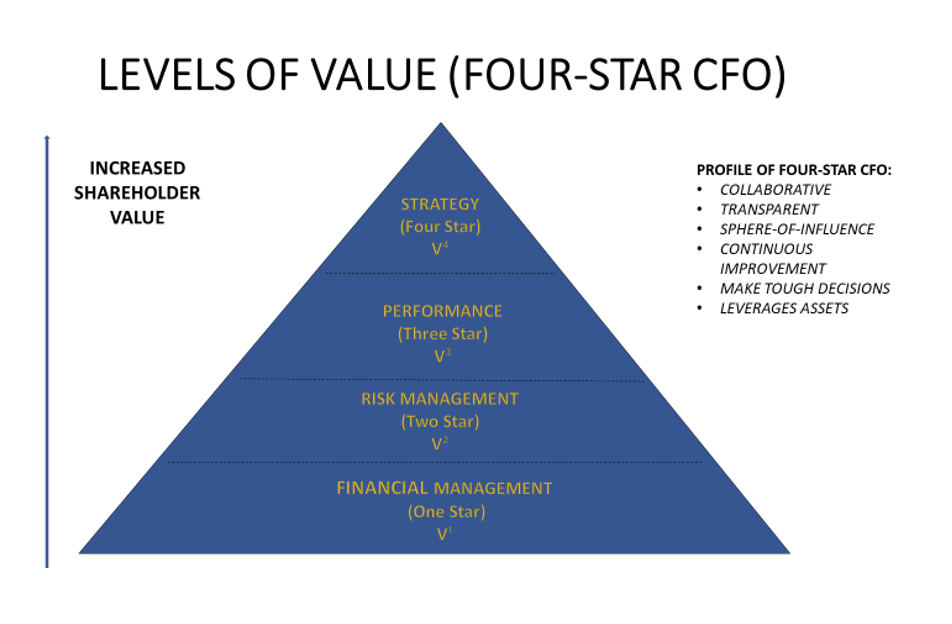

Only highly educated, trained, and experienced CFOs can achieve the four levels of financial responsibility necessary for optimizing the value of a company without a significant learning curve. It takes up to 10 years of experience in-the-seat to achieve this level of accomplishment. Moreover, it is considered a BEST PRACTICE to engage financial professionals outside of the company for fresh-look perspective of potential opportunities for improvement. The incremental value of an experienced financial professional increases geometrically in value by each level of job responsibility as summarized in the chart below.

This chart identifies the four levels of responsibilities expected from a four-star CFO. You should use it in preparing job descriptions and standards of performance before you begin the journey of hiring an accomplished CFO for your company. It is impossible to hire an effective CFO without understanding the performance values expected from the position. Likewise, smaller companies can now receive the benefits of a four-star CFO by engaging a financial professional on a part-time basis.

Financial Management (One Star) V¹:

Financial management is the first level of responsibilities provided by a CFO. It is usually the level of responsibilities expected from promoting your controller or hiring your CPA firm CPA firm accountant to the CFO position. These responsibilities are very important to running a company, but there are so many more responsibilities expected from a four-star CFO. In essence, this level can be classified as the entry level of a newly hired, limited experienced financial professional.

- Prepares financial statement in accordance with GAAP.

- Maintains a system of internal controls in accordance with 17 principles of the COSO Commission.

- Provides accounting oversite and manage accounting functions.

- Provides budgeting, forecasting, and capital planning.

Risk Management (Two Star) V²:

Risk management is the next level of important responsibilities of a CFO. Entry level CFOs do not normally have experience in this area. Risk management is the comprehensive plan to reduce operating risk, thereby protecting the company and ownership from unexpected losses. Risk management also includes the responsible for optimizing benefits to owners and employees. Experience in this area is critical for holding outside service providers responsible for adding value to the company at a competitive price. Inexperienced CFOs rely too heavily on outside service providers resulting in increased cost, reduced benefits, and increased risk exposure.

- Oversees treasury management.

- Oversees risk management.

- Assesses insurance coverage & programs.

- Optimizes working capital.

- Optimizes debt to equity.

- Provides corporate governance such as buy/sell agreements.

- Oversees purchasing.

Performance (Three Star) V³:

This level of responsibility provides meaningful operating experience to the ownership team in running the business. It requires a CFO who has experience in running a business and knows how to optimize and transform existing assets, such as the balance sheet, workforce, and intangible assets, into superior financial performance. Three-star CFOs have a sphere-of-influence that inspires operators in the company to do what is best for the company, not a particular department. This level of CFO operates transparently and has the ability and experience to make the tough calls in running a business. In summary, three-star CFOs look beyond the finance department and focus on company results.

- Collaboratively works with CEO, management team and owners.

- Leads profit-improvement initiatives using sphere-of-influence.

- Holds everyone accountable: employees, management, & vendors.

- Builds high-performing, pay-for-performance culture that aligns to strategy.

- Grows profitable revenue, improves margins, & reduces fixed cost.

- Optimizes cash flow: revenue recognition and speedy collections.

Strategic (Four Star) V⁴:

The fourth level of CFO responsibilities include the ability to operate strategically finding new and improved ways of adding value to the company. Furthermore, four-star CFOs understand the importance of market position and the importance of being indispensable to their customers with recurring revenue and contracts. This experienced CFO can lead the strategic plan and then perform the role of the implementor or COO. A CFO at this level of experience is always looking outside of the company for opportunities to add value and maintains business relationships that facilitates this process. Specifically, he/she can prepare valuations, optimize company and owners tax strategies, lead digital transformation, and plan for upcoming transitions. They know what is important in moving the company forward and secure experts as needed to optimize opportunities. Finally, a four-star CFO is willing to take personal risk and is willing to invest personal funds into the company.

- Orchestrates strategic plan to increase valuation.

- Evaluates M&A and partnership opportunities.

- Oversees IT, HR, & tax strategies.

- Participates in digital transformation.

- Prepares company valuations: cash flow and market approaches.

- Leads succession planning.

- Leads performance management and moves the company to a high-performance culture.

In summary, hire a four-star CFO and begin realizing benefits immediately. A four-star CFO can begin training a financial professional to become your next CFO.

Schedule a meeting with Ed to discuss a performance plan that best suits your company.

Elasak@dreambigexit.com

951-323-0911