Strategic Business Solutions analyzes eight value drivers for increasing shareholder value that were develop by Edward Lasak from his 35 years of experience as a CFO, Treasurer, and COO. These impactful value-building drivers improve a company’s performance and business valuation by growing profitable revenue, improving profit margins, strengthening the balance sheet, increasing free cash flow, and raising its sales multiple.

The ongoing process of deploying these value-building drivers over-and-over again along with full alignment and accountability optimizes operations and unlocks the value of the company. As a starting expectation for most engagements, the goal is to double revenue, increase cash flow five times, and increase the sales multiple by 50% while concurrently reducing operating risk.

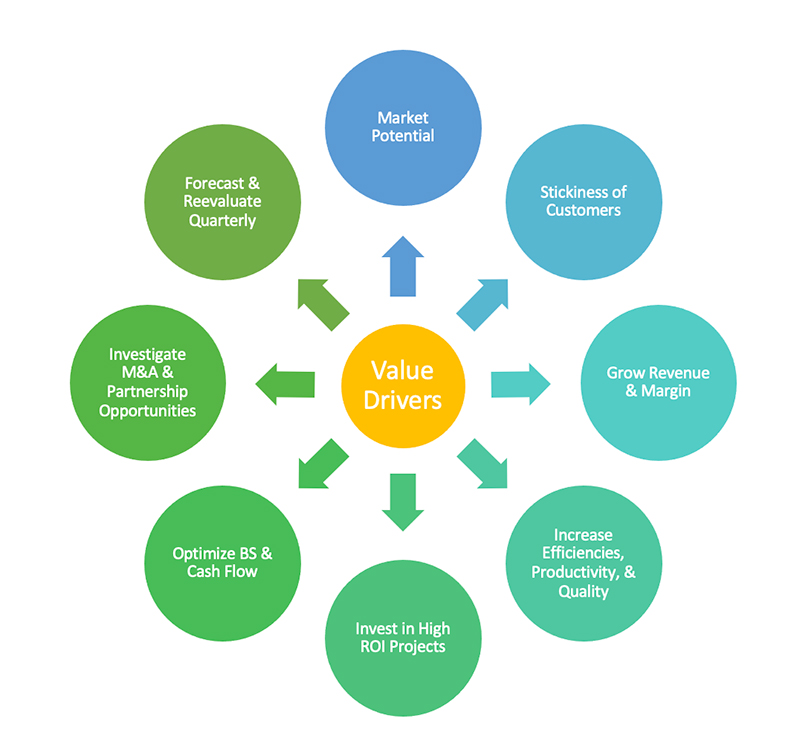

The eight value-building drivers work in concert with one another and are repeated in an ongoing manner, over-and-over again providing a comprehensive and wholistic approach to finding and realizing value. It places everyone on the same page of the playbook with the same terminology and prioritized strategies for executing impactful action plans. It is referred to by us as the Value-Building Wheel.

The Value Building Wheel

Here is a brief description of each value-building driver along with some depth and magnitude of this approach for finding shareholder value.

- Assess market potential: There in nothing more important than analyzing the market and your position in it. It could be a reason for increasing the sales multiple above similar companies in your industry.We ask question like: Can you become number one or two in your marketplace? Are there cracks in the marketplace where you could increase market share and profitable revenue? Can you expand products or services with existing customers increasing customer engagement? Is there an opportunity to expand into adjacent geographic and leverage your fixed cost to support more revenue? Do you know how your competitors and how they would react? Is there an opportunity to offer a better price, better distribution, and/or improved quality?

- Improve customer loyalty and increasing stickiness: Equally important to the market potential is the perceived value of your customers. This is another driver that justifies a greater sales multiple over other companies in your industry and/or market. Just how well are you doing in meeting their expectations and how well do they value your goods and services? The greater you customer engagement, the stickier your customers are to your company. The goal is to become indispensable to your customers with reoccurring revenue, contracts, and legally protected trademarks or patents.With this value driver we ask questions like: Why do your customers pick your company over others? Can you increase rates or reduce working capital without losing business? What is your competitive advantage and how can you further exploit it in satisfying the needs of customers? How can you increase customer engagement? Are you communicating with your customers quarterly? Can you improve the customer experience? Do you have an effective marketing plan tracking results by customer and securing new customers?

- Grow revenue, improve margins & lower fixed cost:

Buyers will pay a higher multiple for a good revenue story. Moreover, the quality of past operating performance and trends makes the accuracy of your forecast more predictable and believable. Here we ask questions like: Are your revenue and margins improving? How do you compare to industry standards? Can you assess contribution margins by customer? Can you analyze customer retention and profitability? Is there an opportunity to add resources to your sales function? Can you add profitable revenue further using existing fixed cost? What stage are you at in the product cycle? - Increase efficiencies, scalability, productivity, & quality: This value driver addresses the effectiveness of producing and delivering your goods and services. It requires a high performing culture and accountability of the workforce. Everyone employed has a metric to achieve. It considers the quality of your goods and services compared to your cost structure.Here we ask questions like: Is there an opportunity to reduce cost? Can you scale your business to reduce fixed costs? Do you measure productivity and quality and have measures in place to improve? Is there alignment with goals and pay? Do you have effective training programs in place? Can you increase productivity and quality with investments in technology? Do you have a strategy for digital transformation?

- Invest in high return on investment (ROI) projects: This value driver focuses on reinvestments back into the company to create value with increased revenue, greater margins, more product offerings, and profitable expansion into new markets with new related products.Here we ask questions like: Are new projects and opportunities evaluated and prioritized based on the return on investment (ROI)? Are you missing out on profit improvements by not reinvesting in the company? Do you know your cost of capital? Have you prepared a three-year capital plan that?• Satisfies regulatory requirements (cost of staying in business).

• Provides redundancy/backup to key processes that support your business continuity plan.

• Investments that improve the customer experience and analytics.

• Investments that capitalized on profitable top-line revenue opportunities such as web sites.

• Investments to improve gross profit margin and/or reduce fixed costs. - Optimize balance sheet & cash flow: This value driver focuses on ways to improve cash flow and reduce working capital. It also addresses the availability of short-term and long-term funding sources by optimizing lines-of-credit and increasing borrowing capacity and opportunities for changes in equity positions. Finally, it addresses the risk of personal guarantees and measures to reduce that contingent liability.Here we ask questions like: Do you plan to free up the use of working capital? Can recognize revenue quickly under GAAP? Do you ask for customer deposits during long project lead times? Can you accelerate customer payment terms? Can you able to turnover inventories more frequently? Can you negotiate more relaxed payment terms with your vendors? Do you have tax strategies to reduce taxes? Do you review key ratios such as liquidity and profitability ratios to see if you are improving? Are you optimizing borrowing capacity, renegotiating banking relationship, and are you improving covenants? Are you exploring equity opportunities for new sources of capital and expertise? Do you have surplus assets? Protect “going concern” with Buy/Sell Agreement.

- Investigate M&A and partnership opportunities. This value driver focuses on opportunities around you. It addresses relationships and knowledge about competitors and potential partnerships that could increase value of several companies working in partnership.

Here we ask question like this: Do you Intimately know your competitor? Do you have a relationship with owners of competing companies? Do you develop productive business relationships through industry groups? Do you know businesses that make similar products or services? Do you consider combing operations with other companies to possible leverage assets and improve margins? Do you research other companies in your marketplace to understand how you are different or similar? Do you look for partnership opportunities with other companies that can add value to your business and would better serve the customer? Do you strategically investigate similar companies that are for sale? - Forecast & reevaluate quarterly. This driver focuses on performance how well are we performing to the action plans identified in the strategic plan.

Here we ask questions like this: Do you review financial statements quarterly with operating team and ownership/board monthly? Do you analyze actual results to goals and projections? Are you on target to achieve strategic plan? Do you update financial forecast monthly looking three years out consistent with strategic plan? Do you review progress and accountability of action to achieve strategic objections? Do you update the business valuation annually based on the latest forecast? Do you update Buy/Sell Agreements and corporate governance documents? Do you review and update succession plans? Is the employment of key employees secured? Are you migrating the owner out of the day0-to-day operation? Do we need new talent to grow the company?