By Edward B. Lasak, CPA

Value-Building Series: Article Two

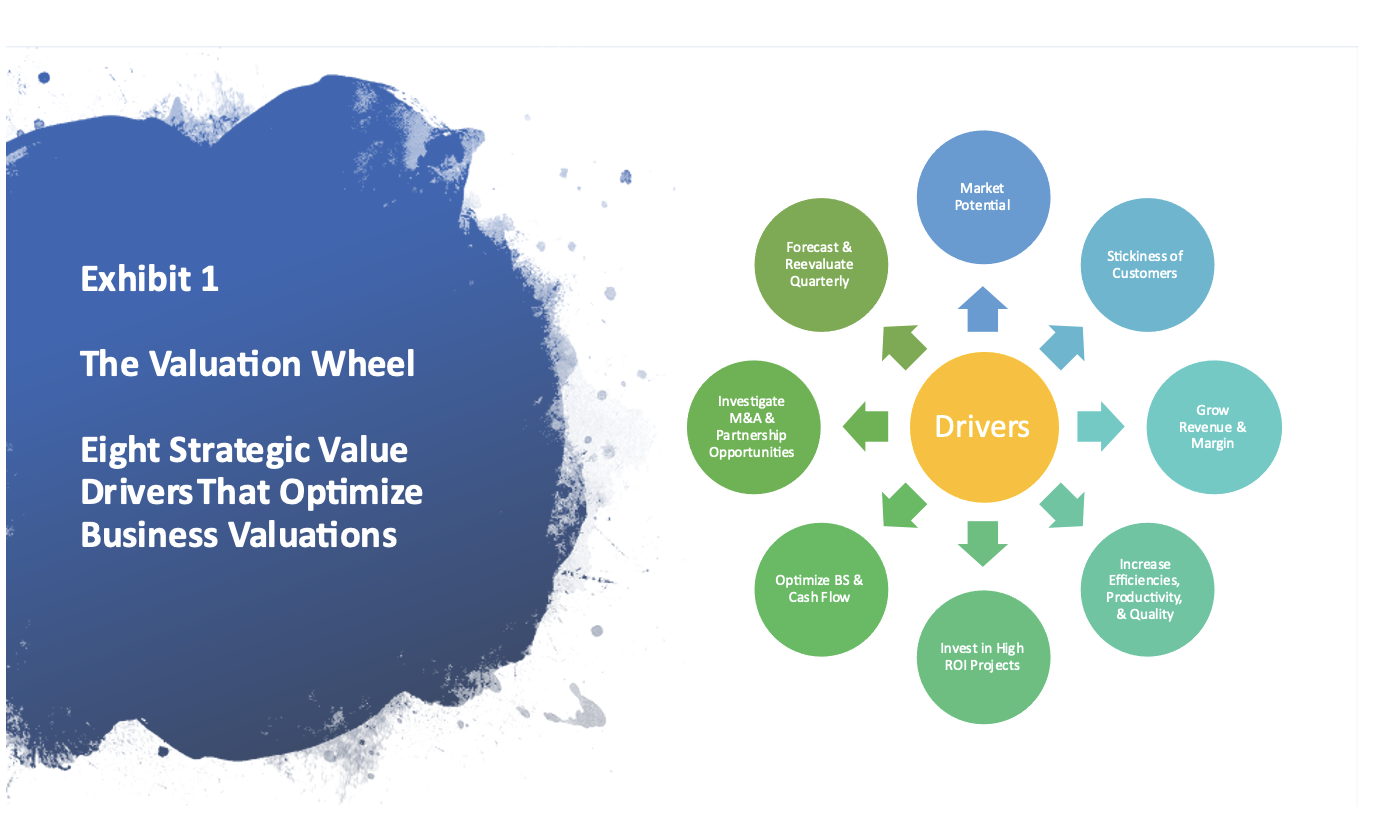

The Valuation Wheel

This article is the second of a series of articles on how to increase business valuations and reduce operating risk by using available value-building models that are available in the marketplace. This analysis comes from 35 years of experience as a CFO, COO, and Treasurer at Public and Private Companies and six years as family business consultant.

Value Building Is a Good Investment. $1 Invested Returns $820 to the US Economy (www.NIST.com).

Introduction

Experienced CFOs are trained to work as an integral leader with operating teams and ownerships to develop and implement strategies that increases shareholder value as well as to reduce operating risk. The value process begins with a comprehensive strategic plan of value-added strategies that are developed from a SWAT (Strengths, Weaknesses, Opportunities, and Threats) analysis, succession planning, and financial statement forecasts for the next three-to-five years. This process provides a roadmap of where the Company is going and how it is going to get there. Company valuations are performed annually to confirm increased shareholder value. Fortunately for business owners and consultants, there are several models available that will assist you in creating shareholder value and reducing operating risk, and therefore, there is no compelling need to reinvent the wheel.

In this article, I will discuss the Valuation Wheel that I created after 35 of experience of managing companies. The Valuation Wheel starts with customer relationships and focuses on key value drivers available for creating value and reducing operating risk. It provides a comprehensive framework of business concepts and best practices arranged by components of the financial statements to identify and analyze value drivers that should be addressed in your strategic plan. Finally, it requires an on-going process where operators and ownerships are focused on optimizing value. It allows one complete flexibility in creating and implementing a strategic plan with no upfront investment, ongoing fees, or specialized rituals and acronyms. To optimize value, this process requires the onsite assistance of an experienced CFO and marketing expert. Hands on experience operating in the seat of responsibility matters most in creating value.

The Valuation Wheel

Good Stewards Are Expected to Build Value.

The Valuation Wheel was developed to build value in companies by incorporating robust value-added strategies into the strategic plan, and then use the plan as a roadmap to evaluate management in achieving these results (see Exhibit 1). As you will readily see, the value-building drivers cover all potential ways of increasing value with a holistic perspective based on valuation methodology and centered around the financial statements which are the key financial parameter of defining success. Some value-building models focus more on the process, whereas the Valuation Wheel focuses more on how to create value. Moreover, successful strategic plans must have both robust value-added strategies as well as an ongoing, rigorous implementation process of leadership, alignment, and accountability to optimize results.

The value-building process starts with a valuation of a company’s “as is” and then develops a strategic plan that can add incredible shareholder value and reduce operating risk. A SWAT analysis along with an integration of value-building strategies from the Valuation Wheel are used by ownership and the management team for developing a comprehensive strategic plan. Financial statements are forecasted out for the next three-to-five years to provide the roadmap of value for evaluating progress, ensuring alignment, and establishing accountability. Internal company valuations are performed annually to confirm the increased shareholder value and reduced risk, and management is rewarded accordingly.

Likewise, the Valuation Wheel is designed to find and optimize value establishing a foundation for upcoming transitions in ownership including sales to third parties, planned family transitions, and ESOPs. Furthermore, all good management teams worth their salt need to grow and add value to the enterprise, otherwise an owner’s best option may be to sell the company and redeploy the capital to other endeavors.

Specifically, the Valuation Wheel is a circular, ongoing system of eight powerful value-building drivers that encourage continuous improvement and build shareholder value with a holistic perspective based on valuation methodology. The first three drivers focus on revenue, the engine of any successful business, and it is broken down by markets, customers, revenue, and gross profit margins. The fourth driver focuses on an efficient process for producing and delivery product and services. It leverages assets such as the workforce, customer service, equipment, and technology to consistently deliver high-quality products and services to its customers. The fifth driver focusses on reinvesting capital back into the business that makes the company more effective at fulfilling its mission and earns high rates-of-return (ROIs) on the capital reinvested in the business.

The sixth driver focuses on optimizing the balance sheet, borrowing capacity, intangible assets, and cash flow. This is the driver where one builds in a sound risk management program to protect assets and future cash flows of the company. The seventh driver looks outside of the company for value opportunities including M&A and working partnerships. This is a growth opportunity often missed by the operating team. Knowledge about competitors and outside opportunities is of utmost importance and can significantly add value to the company and provide a pool of potential buyers when selling. The eighth driver focuses on a monthly and quarterly management review process that evaluates just of how well the management team is doing in meeting the benchmarks, milestones, and financial projections of strategic plan. Succession planning is a key activity of this driver.

The following provides further amplification of each driver, and how the eight driver strategies work together in building value and reducing operating risk.

- Investigate Market Potential:

There is nothing more important to a success of a company than analyzing the market and assessing Company’s position in it. Being number one or two in a market provides strategic advantages to a company for influencing pricing and growing market share without the fear of losing customers. Moreover, this position in the marketplace could justify a higher sales multiple from other companies in that industry. Therefore, understanding your position in the marketplace and your options for improving that position is one of the most important steps for creating value.

In analyzing market potential opportunities, we ask questions like this. Can you become number one or two in your marketplace and what is the required investment to achieve that status? Are there opportunities or cracks in the market to provide new goods and services where you could increase market share and gross profit margins? Can you expand products or services with existing customers to increase revenue, margin, and customer engagement? Is there an opportunity to expand geographically and leverage your fixed cost to support more revenue? Do you know and understand your competitors and how they would react to changes that you are contemplating? Is there an opportunity for offering lower pricing, improving distribution, providing superior quality, and improving customer service to grow revenue and profits?

- Improve Customer Loyalty and Stickiness:

Equally important to market potential is your customers perceived value of your company. The stickiness of your customers defines just how valuable your company is to them. The stickier they are to your company, the less the chances that they will leave you. This stickiness can have a profound impact on your company’s valuation. As with market position, this is another driver that justifies a greater sales multiple over other companies in your industry or market. Every business starts and ends with the perceived value of its customers. Performance factors such as quality, customer service, a superior customer experience, digital convergence, and company image can make your company indispensable with its customers without relying on being the low-cost leader.

With this value driver, we ask questions like this. Why do your customers do business with your company over your competitors? Can you increase billing rates or reduce working capital requirements without losing business? What is your competitive advantage and how can you further leverage it in satisfying the needs of customers? How can you increase customer engagement and improve the customer experience? Are you communicating with your customers quarterly and asking them how well you are doing? Do you have an effective marketing plan in place to track customer satisfaction and securing new customers? Do your customers value the goods and services that you provide to them and do you have surveys in place to support their satisfaction? Can you structure revenue into a recurring revenue, a subscription model, contracts, and/or legally protected trademarks and patents resulting in higher retention rates?

- Articulate Your Story: Gross Revenue and Gross Profit Margins:

It is a known fact that buyers will pay a higher sales multiple for a positive revenue story, especially where revenue streams and gross profit margins are increasing. Of equal importance, one needs to have a robust digital strategy and marketing plan for growing revenue on the web. Generally, higher sales multiples will translate into increased business valuations. Moreover, the quality of past operating performance and trends makes the accuracy of your forecast more predictable and believable. Likewise, it is extremely important to be developing and investing in new sources of revenue so that future revenue streams will continue to grow, thereby demonstrating sustainable revenue growth.

Here we ask questions like this. Are your revenue and margins improving? How does your revenue growth compare to industry standards? Is your revenue concentrated in a few customers? Can you analyze customer retention and profitability through contribution margins? Is there an opportunity to add resources to your sales function to further grow revenue? Can you add profitable revenue further leveraging existing fixed cost? What stage are you at in the product development cycle?

- Increase Efficiencies, Scalability, Productivity, & Quality:

This value driver addresses the effectiveness and efficiency of consistently producing and delivering high-quality goods and services to customers. Value from this driver is derived from employing a motivated workforce that operate in concert with the values of the company and performing jobs that they are properly trained to do. The workforce is supported by a high performing culture where the workforce works together as a team in achieving strategic objectives with full alignment and accountability for results. Everyone employed has performance metrics to achieve and there is nowhere to hide for non-performance. It considers the quality of goods and services consistently provided and the superiority of customer service.

Here we ask questions like: Is there an opportunity to further reduce cost? Can you scale your business to reduce fixed costs as a percentage of revenue? Do you track and measure productivity and quality? Is there alignment with goals and full accountability of performance? Do you have effective training programs in place? Can you increase productivity and quality with improved processes and tools? Do you have a strategy for digital convergence? Do you have the right people on board that embrace the values of the company and are they in the right positions? Are you migrating the owner out of the day-to-day operations?

- Invest in High-ROI Projects:

This value driver focuses on reinvesting capital back into the company to create value with increased revenue, improved margins, superior product or service offerings, and profitable expansion into new markets with new and existing products and services. A focused capital plan that prioritizes investment opportunities prioritized by return-on-investment (ROI) is a key building block for adding shareholder value.

Here we ask questions like: Are new projects evaluated and prioritized based on its ROI? Are you building superior solutions, products, and services for your customers? Are you missing out on profit improvement opportunities by not reinvesting in the company? Do you understand your cost of capital? Have you prepared a capital plan that supports your strategic plan?

Capital planning is a key component of this value driver. Capital projects should be vetted, evaluated, and prioritized based on the following criteria:

- Is a capital investment necessary to meet regulatory requirements? This is considered a cost of staying in business.

- Does the capital investment produce a superior ROI? Likewise, high return projects should be implemented ASAP.

- Does the capital investment provide redundancy and backup to key processes that support your business continuity plan? Customers expect that their orders will be fulfilled even during emergencies and natural disasters.

- Does the capital investment improve product or service quality, customer service, or the customer experience?

- Are you investing in new technology and digital convergence?

- Optimize Balance Sheet and Cash Flow:

This value driver focuses on ways to increase cash flow, improve borrowing capacity, mitigate operating risk, reduce working capital, and implement strong corporate governance. The goal with this value driver is to fully optimize every asset on the balance sheet including goodwill and debt to equity. It addresses the availability of short-term and long-term financing sources by optimizing lines-of-credit, payment terms, collection practices, and borrowing capacity. It stives to optimize performance by striking the optimal balance between long-term debt and equity. Finally, it minimizes the risk of personal guarantees and rewards effective corporate governance.

Here are some of the questions addressed with this value driver. Do you analyze opportunities to free up the use of working capital allowing you to minimize the use of lines-of-credit? Is there an opportunity to recognize revenue quickly under Generally Accepted Accounting Practices (GAAP)? Do you require customer deposits for projects requiring long projected lead times? Are you able to turnover inventories more frequently? Do you have tax strategies in place to reduce taxes? Do you review key ratios such as liquidity and profitability ratios to see if you are improving? Are you optimizing borrowing capacity, renegotiating banking relationship, and improving bank covenants? Are you exploring equity opportunities for new sources of capital and expertise? Do you own surplus assets or underperforming assets? Are you protecting your going concern with annually updated Buy/Sell Agreements?

- Investigate M&A Opportunities and Mutually Benefiting Partnerships:

This value driver focuses on opportunities that are available outside of the company. This value builder identifies opportunities with business associates and competitors through teamwork, combined operations, or strategic partnerships. Leadership focusing solely internally will miss out on substantial potential benefits of combining operations. These opportunities may seem awkward at times, but if both companies benefit financially, why not pursue a partnership or merger. Likewise, M&A opportunities should be investigated and analyzed to see if there is strategic value. Finally, is there an opportunity to insource or outsource segments of the operation to reduce fixed costs?

Here we ask question like this. Do you know your competitors, and do you benchmark operations with them? Do you have a relationship with owners of competing companies? Do you develop productive business relationships through industry groups? Do you know businesses that produce and offer similar products or services? Do you consider combing operations with other companies to possibly leverage assets and improve margins? Do you research other companies in your marketplace to understand how you are different or similar? Do you look for partnership opportunities with other companies that can add value to your business and would better serve the customer? Do you investigate like-kind companies for that are for sale?

- Forecast and Reevaluate Performance Quarterly:

This driver reviews and evaluates performance to the milestones, action plans, and the financial statement projections identified in the strategic plan. It is a time to evaluate the performance of the management team for alignment and accountability focusing on what is working and what needs improvement. As part of this process, full financial statement projections should be updated based upon revised assumptions and performance factors. Finally, succession plans should be evaluated, and deficiencies corrected quarterly as part of the review process.

Here we ask questions these kinds of questions. Are financial statements reviewed monthly or quarterly with operating team and ownership? Do you analyze actual results comparing them to forecasts, budget, and last year and understanding performance variances? Are you on target to achieve financial statement milestones of the strategic plan? Do you update financial forecasts monthly looking three-to-five years out consistent with strategic plan? Do you review progress and accountability for achieving action plans? Do you update the business valuation annually based on the latest forecast? Do you review and update succession plans? Is the employment of key employees secured? Are you migrating the owner out of the day-to-day operation? Do we need special skills and new talent to grow the company?

Transitions and Business Exits

Transitions to next generation ownership can be planned over time as part of this process. Transition planning is ongoing and requires a three-to-five-year process to ensure success. It is not a one-time event prepared in 90 days or so like some may believe. The goal is to increase shareholder value and reduce operating risk so that the owners have more transition options, greater flexibility, and increased value when it is time to transition out of the business.

Transitions are personal decisions, and the right option depends upon the desires of owners and what it best for them and their families. In general, many owners are reluctant to plan directly for transitions for many reasons, so increasing value is one way of moving forward on the tough topic. Some service providers are looking for the opportunity to sell these businesses to outside parties, but the most common practice in real life, is to transition these businesses to a new CEO within the family. Besides building value, internal communication between family members and stakeholders is of utmost importance.

Conclusion

Management teams, owners, and Boards of Directors should implement a value-building model that is in complete alignment and with full accountability with its company’s strategic plan. It is the responsibility of a good steward to do so.

The Valuation Wheel is a value-building model that can be used to build value and reduce operating risk. It is a comprehensive model that intensely focuses on eight value-building strategies that can be used along with the SWAT analysis for developing a robust strategic plan. It then incorporates forecasts of the financial statements as the overall scorecard and adopts monthly or quarterly meetings to keep management on track, accountable, and in alignment with strategic the plan. It is best implemented for optimal value with the services of an experienced CFO and marketing consultant.

The author is completely agnostic as to what value building model is used. One may be best served by understanding the strengths and shortcomings of each model, and then designing a specialized model for your company. This adaptability can produce exceptional results but may take greater skills and more experience to implement and adjust based on performance. No matter what model you select, it is important to get started as soon as possible and apply it rigorously to realize optimal results.

Once a value building model is selected, it is critical to conduct monthly or quarterly assessments with your management team defining the value created and adjusting your road map moving forward. Also, an annual valuation should be conducted to confirm shareholder value secured. Outside assistance will help keep the process moving and results achieved as planned.

About the Author

Edward B. Lasak

Ed is a business strategist who has 35 years of experience working as a CFO, COO, and Treasurer at publicly and privately owned companies as well as local government. From his unique experience, he is skilled at using financial numbers and valuation methodology as operational metrics in managing operations and distribution for greater performance. He also successfully leverages IT solutions and new technology for improved operations. Ed is a CPA and has a Bachelor and Master of Science Degrees from Illinois State University. He is certified as a COSO Internal Control expert by the American Institute of Certified Public Accountants.